Your customers' affordability in real time

Access a comprehensive analysis of your customers' financial behavior to help you make the right decisions.

Credit Insights is built on a robust technology stack and a suite of proprietary algorithms that form the core of our approach:

- An automatic banking data clustering engine, capable of identifying recurring income and expenses from raw transactions.

- A natural language processing (NLP) engine, which accurately classifies transactions and helps detect subtle risk signals.

This analytical foundation enables us to provide a detailed, reliable, and real-time view of credit applicants’ financial situation, supporting fast, automated, and responsible decision-making.

vous adressez-vous ?

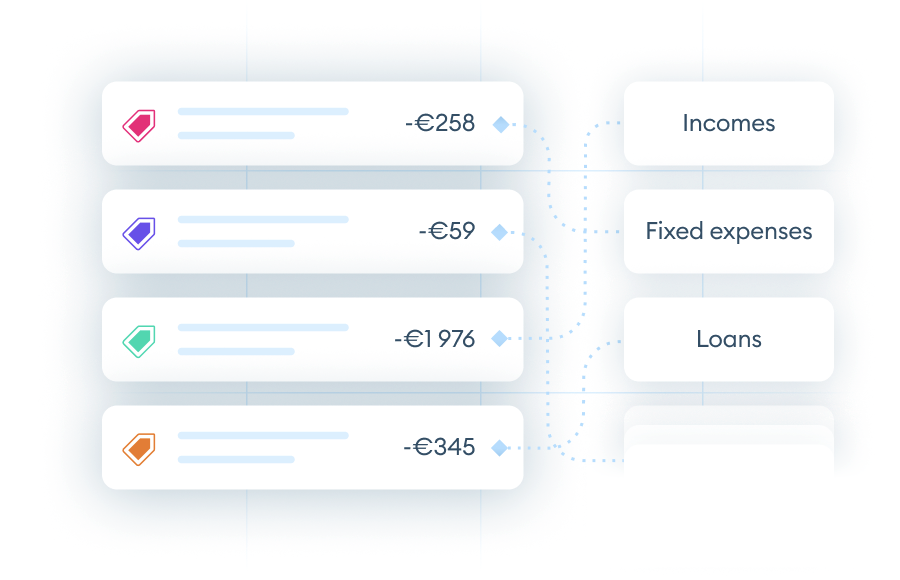

Credit Insights analyzes Open Banking data and automatically classifies income and expenses into over 90 categories specifically designed for personal credit assessment.

This highly precise categorization provides an accurate view of a credit applicant’s financial situation: fixed costs, recurring income, subscriptions, loan installments, and more.

It’s the first step in building a clear, reliable, and actionable financial profile for your decision-making processes.

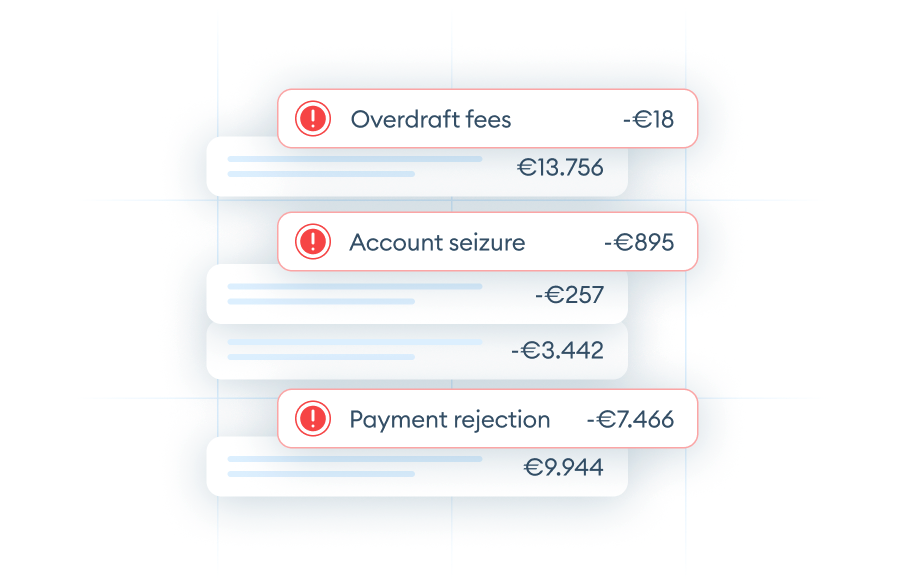

Credit Insights instantly identifies subtle financial risk signals from banking transactions: payment incidents, account garnishments, overdraft fees, authorized overdraft, salary advances, and more.

These key indicators significantly enhance your view of customer risk, going far beyond information derived from socio-demographic data.

This allows you to gain greater analytical precision and improved foresight in your credit decision-making.

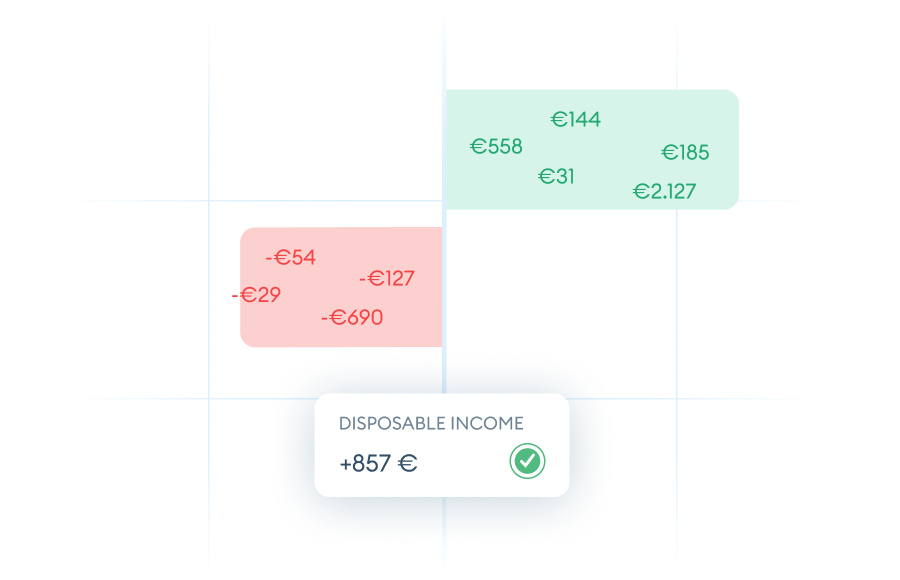

Beyond transaction history, Credit Insights automatically calculates disposable income from banking data.This information allows you to determine the applicant’s actual repayment capacity, taking into account their ongoing expenses and financial commitments. It’s a key lever for tailoring your credit offers in a personalized and responsible way.

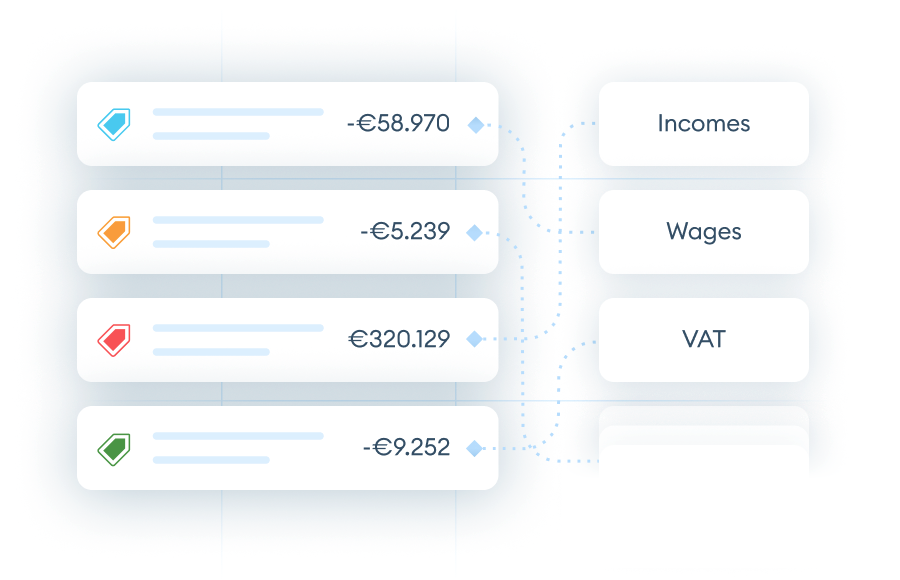

Credit Insights for Businesses offers a specific categorization of business banking transactions, with over 25 categories tailored to freelancers and small businesses.

Thanks to advanced data clustering and classification algorithms, each transaction is automatically categorized (income, social contributions, salaries, taxes, VAT, etc.), allowing you to reconstruct a true snapshot of the profit and loss statement using only banking data — a source of perfectly up-to-date information, unlike traditional accounting documents.

Additionally, Credit Insights for Businesses automatically identifies financial risk indicators (payment incidents, account garnishments, overdraft fees, authorized overdraft exceedances, salary advances, and more), providing an enriched, real-time view of a company’s financial health, far beyond the indicators available from traditional records.

Credit Insights automatically calculates a wide range of financial indicators from a company’s banking data, providing a clear and actionable view of its financial situation: income and expense analysis, cash flow and repayment capacity measurement, monitoring of payment behaviors, and more.

The goal is to provide credit teams with reliable and granular information to refine their decisions, reduce risk, and accelerate the lending process.

Incomes

Wage, pension, rental incomes.

Fixed expenses

Energy, telecoms, various subscriptions...

Housing

Mortgage, rent...

Loans

Consumer loans, leasing auto, BNPL...

Benefits

Family allowances, housing benefit...

Family

Childcare costs, alimony paid or received...

Transfers between accounts

Bank charges and incidents

Rejected payments, late payment fees, intervention fees, etc.

Income from activities

Fixed expenses

Rent, monthly charges, OPEX...

Wages

Financing

Loans, investments, advances on shareholder current accounts

Social security contributions

Social deductions

Taxes and duties

VAT, corporation tax

Transfers between accounts

Mutual insurance companies and provident funds

Bank charges and incidents

Overdrafts, payment rejections, seizures, etc.

assessment of credit risk

accurate credit risk assessment

Do you have a question about Credit Insights?

See our FAQ or contact us for more information.

What is Credit Insights?

Credit Insights is a product that categorizes transactions and contains a list of indicators you can use in your credit decision engine. More details in our documentation.

How quickly is an account analysis available?

Analysis time depends on the number of accounts and transactions. In the vast majority of cases, our analyses are ready in a matter of seconds.

How many tests can I perform?

Our free plan allows you to make 100 API calls/month. Once your product is in production, we can increase the monthly call quota according to your needs.

How do I get my API key?

The API key is available in our console. Select the project of your choice and click on API Credentials. Here you'll find the client_secret and client_id for your API calls.

Publications

A project? A question?

Looking to change the way you make credit decisions? Let's talk!